Solution Provided:

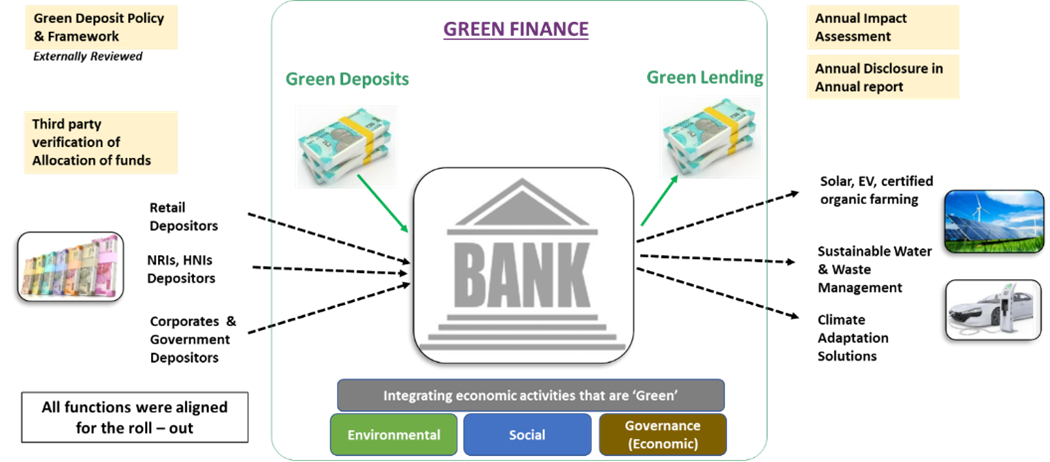

The Net Zero commitment by our country & UN Sustainable Development Goals (SDGs) have given a renewed focus to Green finance. The banking sector plays a catalyst in redefining ‘business as usual’ and steer the transition towards sustainable future.

As per evolving scenario, regulator’s focus is to work towards green finance to address climate change risks. There is also a strong push from investors as well to align portfolios to reduce emissions. Furthermore, Customer’s inclination towards green finance products is on a rise.

9 Proceeds are well defined which will be financed with Green Deposits. Exclusion list is also defined to avoid Greenwashing. Criteria for escrow account for unused fund was pivotal for success of the raise. Responsibility Matrix define to make the framework operationalize.

Reasonable Assurance of deployment was necessitied to give confidence to depositors and Impact Assessment of funds framed to provide much needed ‘wow’ factor.

Impact

Green Finance is not limited to finance sector only and can give access to raise low-cost money to other sectors as well. For example we can research, write thesis, define proceeds and help companies establish avenues for Sustainable funding by avoiding greenwashing.